irs tax levy on social security

Under this program the IRS can generally take up to 15 percent of your federal payments including Social Security or up to 100 percent of payments due to a vendor for. The IRS has assessed your tax debts and sent you an official message requiring payment 2.

Appealing An Irs Tax Levy When And How To Request

First the IRS may make a continuous levy on a taxpayers salary and wages.

. Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the. The IRS can levy a taxpayers Social Security payments to pay unpaid taxes. This applies to Social Security disability program payments retirement payments and.

The IRS can utilize the automated Federal Payment Levy Program or use a manual levy. Under IRC Sec 6331 h the IRS is permitted to levy 15 to pay delinquent tax debts. If a levy is placed on your social security benefits the IRS is able to take 15 percent of your social security payments to satisfy your debt.

More than 44000 up to 85 percent of your benefits may be taxable. The IRS can only seize your property or levy your SSI benefits if. Filing single head of household or qualifying widow or widower with 25000 to 34000 income.

TAS Helps Taxpayer Stop IRS Levy Against Social Security Benefits Every year the Taxpayer Advocate Service TAS helps thousands of people with tax problems. If you receive benefits under the Federal Old-Age and. You did not pay or resolve your.

You can also take a few. Different rates apply for these taxes. Section 207 of the Social Security Act 42 USC.

However you will have some time to pay your tax debt before this garnishment occurs. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. The IRS sent you a CP91 notice because you receive social security and according to their records have unpaid back taxes that they plan to offset with a levy on your social.

The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099 Social Security Benefit Statement and. The amount that the IRS is able to levy your social security is 15 of your monthly benefits. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

In June 2013 the IRS served a notice of levy on the Social Security Administration seizing Mr. Social Security levies like wage levies are continuous and apply until a taxpayers tax debt is paid. 407 protects Social Security benefits from garnishment levy or other withholdings by the federal government except.

Fifty percent of a taxpayers benefits may be taxable if they are. Fifty percent of a taxpayers benefits may be taxable if they are. Second the IRS may make a continuous levy of up to 15 amount of certain federal payments.

IRS Tax Audit Defence. The short answer is yes the IRS can place a levy on Social Security benefits. Deans entire social security benefit 8 In September 2017 the ten-year collection period.

Though the IRS has many different ways to collect a tax. The IRS can levy a taxpayers Social Security payments to pay unpaid taxes. A common misconception is the IRS is limited to levying 15 of the social security received.

Where former IRS agents who can settle your tax debt with the IRS and get your Social Security benefits restored. Social Security levies like wage levies are continuous and apply until a taxpayers tax debt is paid.

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Social Security Tax Considerations Tax Expatriation

Tax Liens And Levies Tax Attorney Orange County Ca Kahn Tax Law

Tax Levy Understanding The Tax Levy A 15 Minute Guide

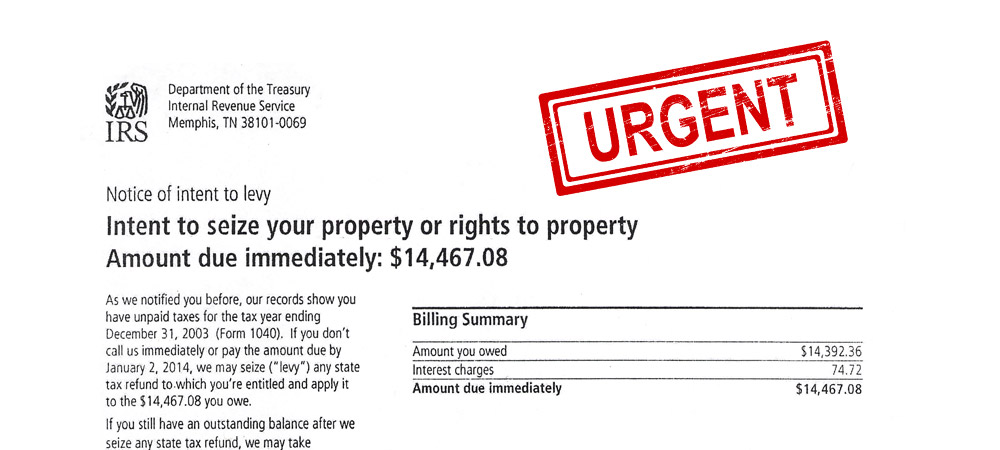

Notice Of Intent To Levy 20 20 Tax Resolution Tax Debt Experts

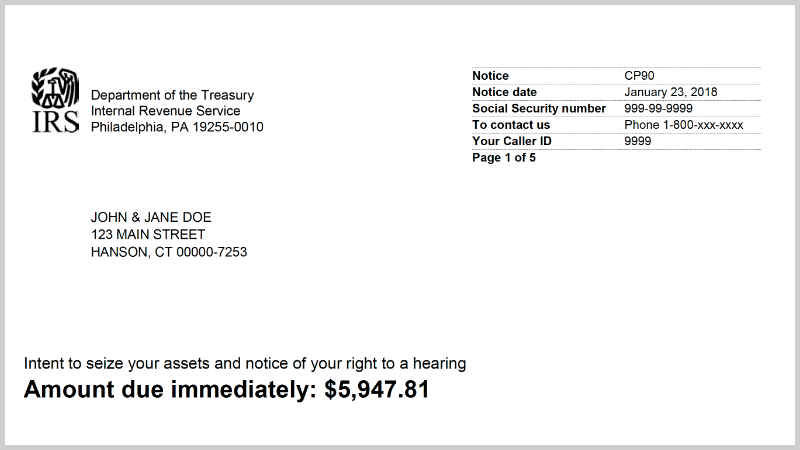

Notice Cp 90 297 297a Notice Of Levy And Right To A Hearing Tax Defense Group

5 11 7 Automated Levy Programs Internal Revenue Service

Tax Levy Release Stop Irs Levies Tax Controversy Services

When Can The Irs Take Your 401k Or Pension For Unpaid Taxes

Can The Irs Levy More Than 15 Of Social Security

How Does An Employer Comply With An Irs Wage Levy Wagner Tax Law

Can The Irs Garnish Your Social Security Payments The W Tax Group

State Tax Levy How To Stop A Tax Levy Legal Tax Defense

Levies Taxpayer Advocate Service

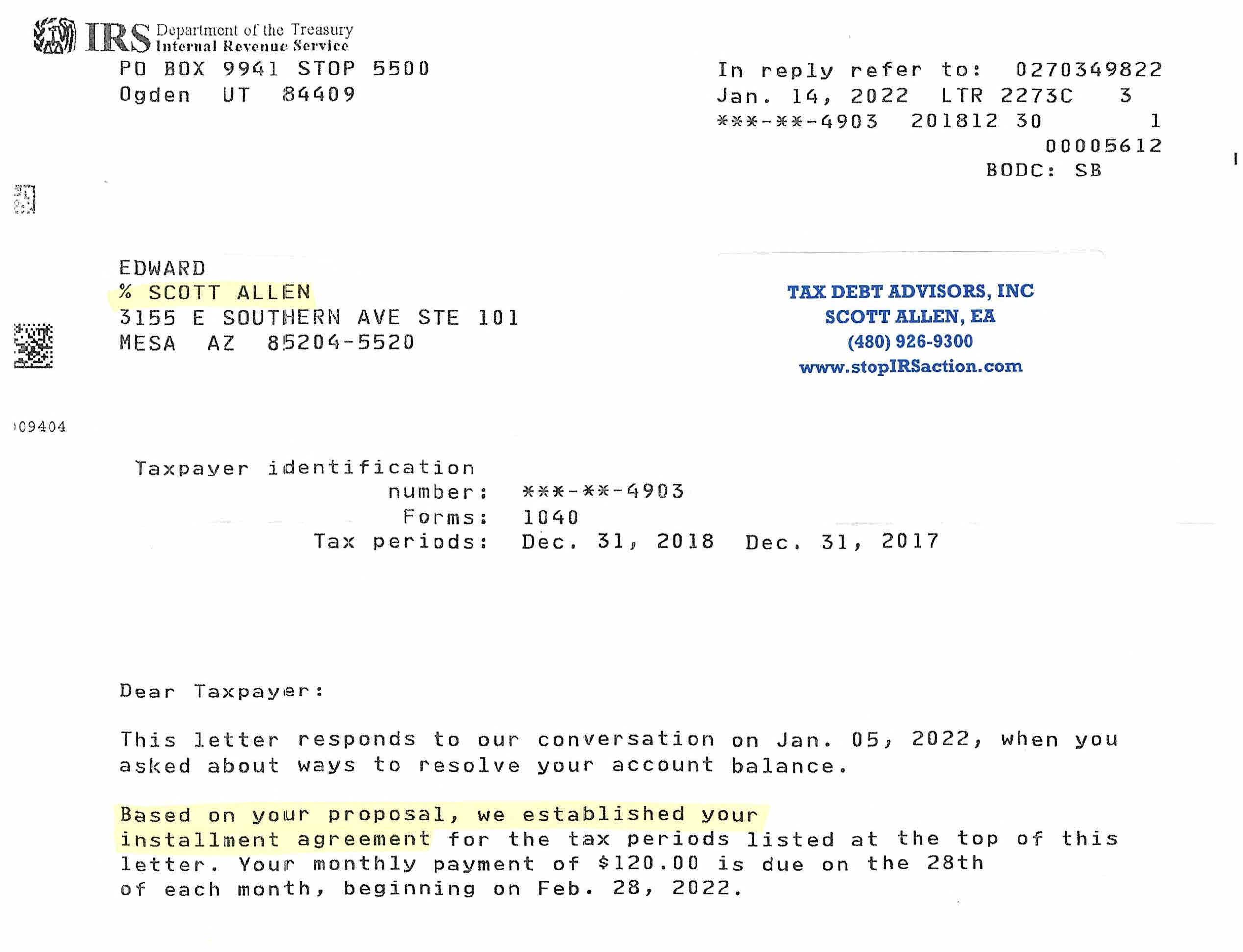

Mesa Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Irs And State Bank Levy Information Larson Tax Relief

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

Irs Audit Letter Cp92 Sample 1

Easiest Way To Release An Irs Levy On Social Security Benefits Youtube